vermont state tax form

State government websites often end in gov or mil. Vermont State Income Tax Return forms for Tax Year 2021 Jan.

Vermont Credit for Income Tax Paid to Other State or Canadian Province.

. How to write a town plan. State Withholding Worksheet Retirement Office Worksheet Form. Nonresident alien who becomes a resident alien.

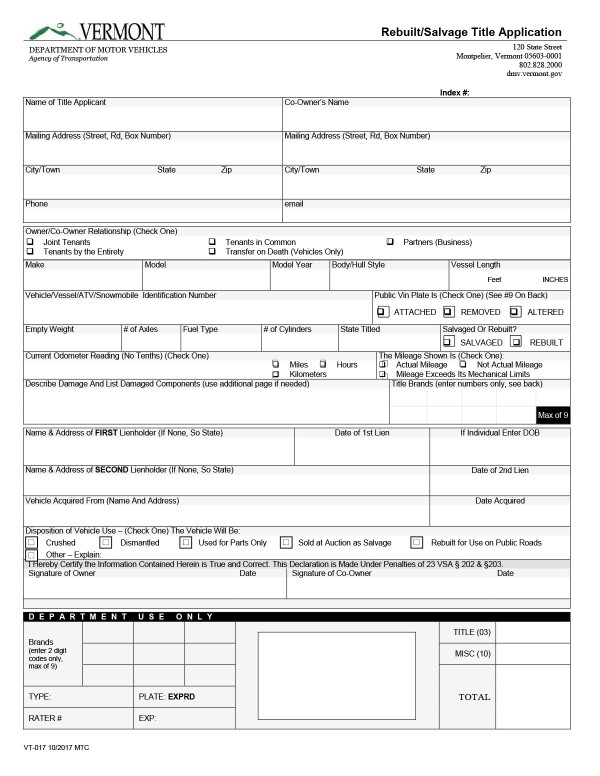

Details on how to only prepare and print a Vermont 2021 Tax Return. Download Or Email Form HS-122 More Fillable Forms Register and Subscribe Now. To record dealer vehicle exchanges and transactions completed by the dealer.

IN-111 Vermont Income Tax Return. State Tax Taxes information registration support. W-4VT Employees Withholding Allowance Certificate.

Information about updating registration or title after the death of the owner. IN-111 IN-112 IN-113 IN-116 HS-122 PR-141 HI-144. Form Wed 03162022 - 1200.

S-3pdf 8943 KB File Format. How to get travel information. Accepted for tax year 2021 homestead declaration and property tax credit filing.

Ad Download Or Email Form HS-122 More Fillable Forms Register and Subscribe Now. Vermont tax forms are sourced from the Vermont income tax forms page and are updated on a yearly basis. These back taxes forms can not longer be e-Filed.

This booklet includes forms and instructions for. PUBLIC INFORMATION REQUESTS TO. Office of the State Treasurer 109 State Street Montpelier Vermont 05609 Main Phone.

Designation of Beneficiary Form Designation of Beneficiary Form. Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. Vermont Sales Tax Exemption Certificate For Purchases For Resale By Exempt Organizations And By Direct Pay Permit.

However if you owe Taxes and dont pay on time you. Wednesday March 16 2022 - 1200. How to get state or federal contracts for a business.

The appropriate Form W-8 or Form 8233 see Publication 515 Withholding of Tax on Nonresident Aliens and Foreign Entities. A Purchase and Use Tax Computation - Leased Vehicle Form form VD-147 may be submitted in. June 16 2021.

How to know if a project needs a review from the State Historic Preservation Office SHPO How to find out if a building is listed on the State or National Register. 15 2020 but the town may assess a penalty. Information provided on 1099-G forms is based on the records of the Unemployment Insurance Division of the Vermont Department of Labor.

Tax on certain types of income. Most states will release updated tax forms between January and April. Homestead Declaration AND Property Tax Credit Claim.

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Federal Withholding Worksheet Retirement Office Worksheet Form. The registration application is received from a Vermont Dealer or a Vermont Dealer acting on behalf of the Lessor.

Before sharing sensitive information make sure youre on a state government site. Individual Income Tax 20. Ad New State Sales Tax Registration.

If the individual purchases this vehicle at the end of the lease they will pay tax on the residuallease end value of the vehicle. IN-111 IN-112 IN-113 IN-116 HS-122 RCC-146 HI-144. 39 rows 2021 Vermont Income Tax Return Booklet.

Vermont has a state income tax that ranges between 335 and 875 which is administered by the Vermont Department of Taxes. W-4P IRS Tax Withholding Form. The Vermont income tax rate for tax year 2021 is progressive from a low of 335 to a high of 875.

Vermont has a state income tax that ranges between 3350 and 8750. Be sure to verify that the form you are downloading is for the correct year. HS-122W Vermont Homestead Declaration andor Property Tax Credit.

Use a vermont state tax form 2020 template to make your document workflow more streamlined. Commercial Vehicles CVO Enforcement. Retiree Direct Deposit Form Retiree Direct Deposit Form.

The 2022 state personal income tax brackets are updated from the Vermont and Tax Foundation data. Vermont School District Codes. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

This booklet includes forms and instructions for. DUE DATE April 15 2020. VT-013-Gift_Tax_Exemptionpdf 20754 KB File Format.

IN-119 2020 Instructions 2020 Vermont Economic Incentive Income Tax Credits. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. 2020 Vermont Income Tax Return Booklet.

Dealer Renewal Packet - includes DMV forms VD-006 VD-008 VD-114 VD-114a. Vermont Department of Motor Vehicles 120 State Street Montpelier VT 05603-0001. Below are forms for prior Tax Years starting with 2020.

TaxFormFinder provides printable PDF copies of 52 current Vermont income tax forms. Printable Vermont state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. To order DMV stickers forms manuals and other supplies by licensed Vermont Dealers.

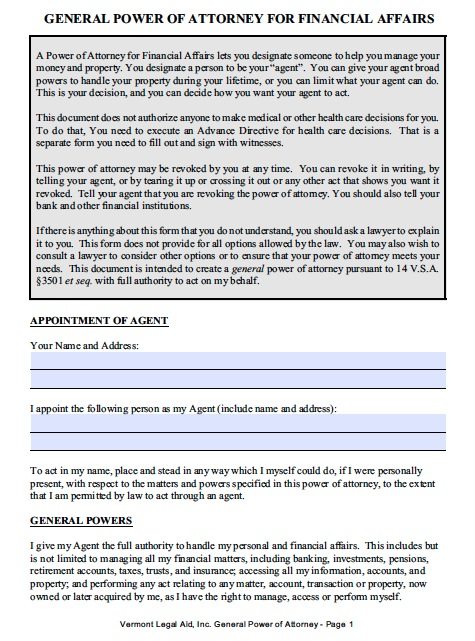

PA-1 Special Power of Attorney. Generally only a nonresident alien individual may use the terms of a tax you are subject to atreaty to reduce or eliminate US. If claimants believe their 1099-G to be incorrect ie Name and SSN do not match or an incorrect benefit amount etc they may complete the Departments online form to request a Corrected 1099-G.

The state income tax table can be found inside the Vermont Form IN-111 instructions booklet. To request exemption of tax based upon gift when a vehicle was previously registered andor titled by the donor and is gifted with no money exchange and no current lienholder to be listed to a family member as defined acceptable by this form. The current tax year is 2021 with tax returns due in April 2022.

How to apply for a state designation program. If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penalty. Business and Corporate Exemption Sales and Use Tax.

For details on late filing see the instructions. You may file up to Oct. Vermont State Income Tax Forms for Tax Year 2021 Jan.

2022 Property Tax Credit Calculator. 31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due date. 802 828-2301 Toll Free.

Form FTPA-PA-1 State CIGARETTE PACT Act Report for Vermont. Retiree Change of Address Form Retiree Change of Address Form.

About Bills Of Sale In Vermont Key Forms Information

Publications Department Of Taxes

Tax Year 2021 Personal Income Tax Forms Department Of Taxes

Free Vermont Motor Vehicle Bill Of Sale Form Vt 005 Pdf Eforms

Virginia Tax Forms 2021 Printable State Va 760 Form And Va 760 Instructions

What Is A W 9 Tax Form H R Block

Fillable Online State Vt Vermont Use Tax Return State Of Vermont State Vt Fax Email Print Pdffiller

Complete And E File Your 2021 2022 Vermont State Tax Return

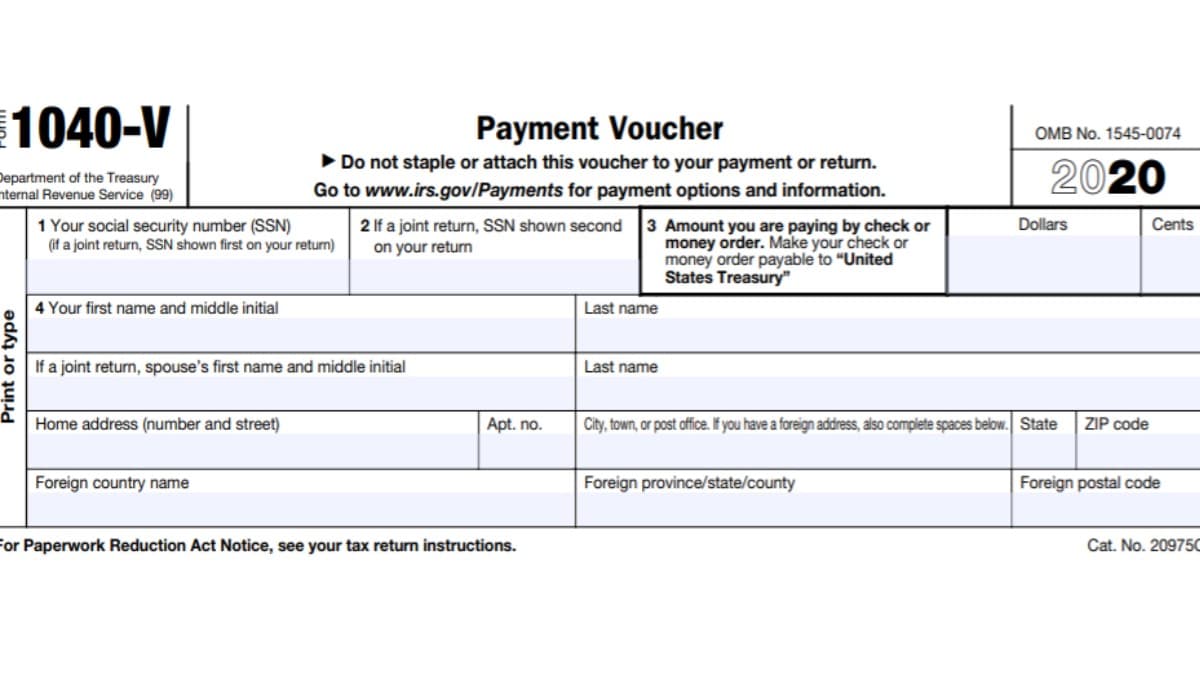

1040 V Tax Form 2021 2022 1040 Forms Zrivo

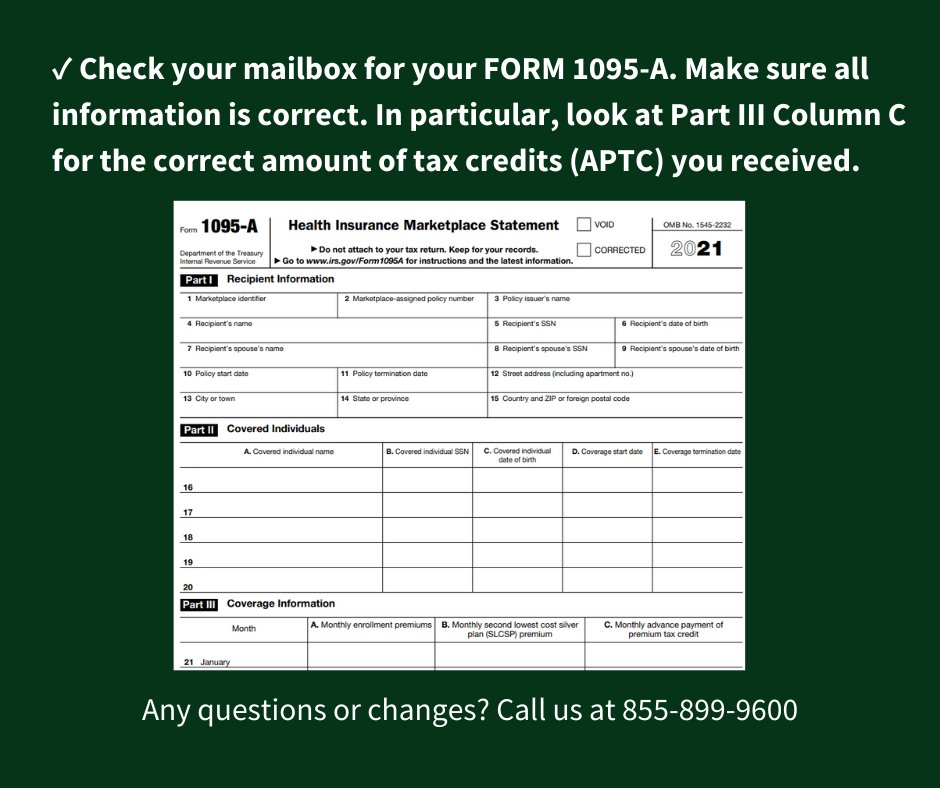

Vermont Health Connect Facebook

Tax Year 2021 Personal Income Tax Forms Department Of Taxes

Free Vermont Power Of Attorney Forms Pdf Templates

Personal Income Tax Department Of Taxes

Vermont Gov Vermontgov Twitter

Where S My Refund Vermont H R Block

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

Oklahoma Tax Forms 2021 Printable State Ok 511 Form And Ok 511 Instructions